Undergraduate Programme

UH6343003 - International and Offshore Banking

Programme & Code

Bachelor of International Finance (International and Offshore Banking) With Honours

UH6343003

Mode & Duration of Study

Full Time

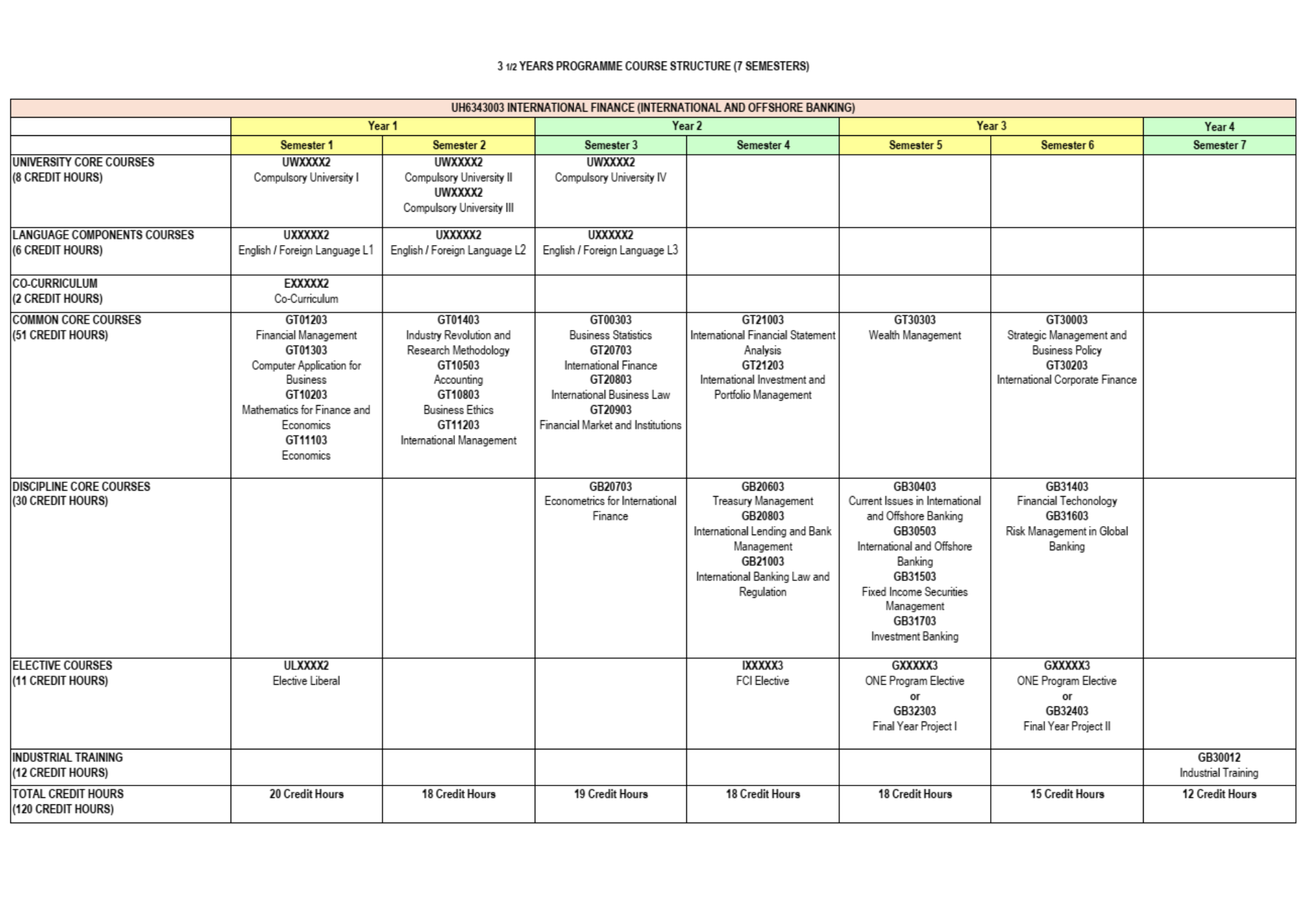

7 Semesters (3.5 Years)

7 Semesters (3.5 Years)

MQA Reference Number

MQA/FA10952

Programme Info

The one and only programme in Malaysia that is developed to provide students some fundamental and applied knowledge in the field of international and offshore banking. Among the core subjects are credit management, Information Systems for Banking, International Money and Capital Market and Wealth Management.

Programme Educational Objectives (PEOs) & Programme Learning Outcomes (PLOs)

PEO 1

Continuous Professional Development: Graduates optimising their knowledge in

international finance and banking institutions, combined with critical thinking and problem solving, directly contribute to society and the nation, exemplifying continuous professional development (PLO 1, PLO 2).

PEO 2

Practical skills, teamwork, social skills and communication skills: Graduates of the programme are equiped through practical based solutions, teamwork, social engagement and communication (PLO 3, PLO 4, PLO 5).

Practical skills, teamwork, social skills and communication skills: Graduates of the programme are equiped through practical based solutions, teamwork, social engagement and communication (PLO 3, PLO 4, PLO 5).

PEO 3

Organization and Societal: Graduates of the programme contributes to sustainable

development through managerial, digital, and data analytical skills in international and offshore banking to fulfill organization and society’s needs. (PLO 6, PLO 7, PLO 8).

PEO 4

Professionalism: Graduates of the programme establishes themselves as

working professionals in financial institutions or related fields. (PLO 9, PLO 10, PLO 11).

PLO 1 ⇒ To acquire knowledge, facts, concepts or theories of international finance and banking that is crucial foundation of any banking business establishments. (Knowledge)

PLO 2 ⇒ To think critically in applying knowledge and able to suggest solutions to fellows, customers, marketplace and society in general. (Cognitive)

PLO 3 ⇒ To apply a range of business and finance tools, methods or procedures to help management in decision making. (Practical Skills)

PLO 4 ⇒ To work collaboratively with diverse social and cultural background in fulfilling social skills and peers engagement. (Interpersonal Skills)

PLO 5 ⇒ To demonstrate well-structured ideas, information, arguments or context effectively either in oral, written or visual forms using various methods of communication tools or channels. (Communication Skills)

PLO 6 ⇒ To use information systems and appropriate technology to achieve organization goals and resolving organizational problems. (Digital Skills)

PLO 7 ⇒ To analyze, interpret and evaluate universal business or financial data to help management in decision making. (Numeracy Skills).

PLO 8 ⇒ To lead a team in planning, organising, implementing and provide monitoring mechanism pertaining to finance and banking issues in pprofessional manners. (Leadership, Autonomy & Responsibility).

PLO 9 ⇒ To demonstrate high appreciation of people skills and establish stronger peers-to-peers collaboration via various in class assignments and independence project assessments. (Personal Skills).

PLO 10 ⇒ To work effectively in one team to integrate knowledge and competency in entrepreneurial activities via selected project(s).(Entrepreneurial Skills).

PLO 11 ⇒ To perform review on finance and banking entities with professionalism that is consistent with ethics and values. (Ethics & Professionalism).

Career Prospect

Admission Requirements

Programme Structure

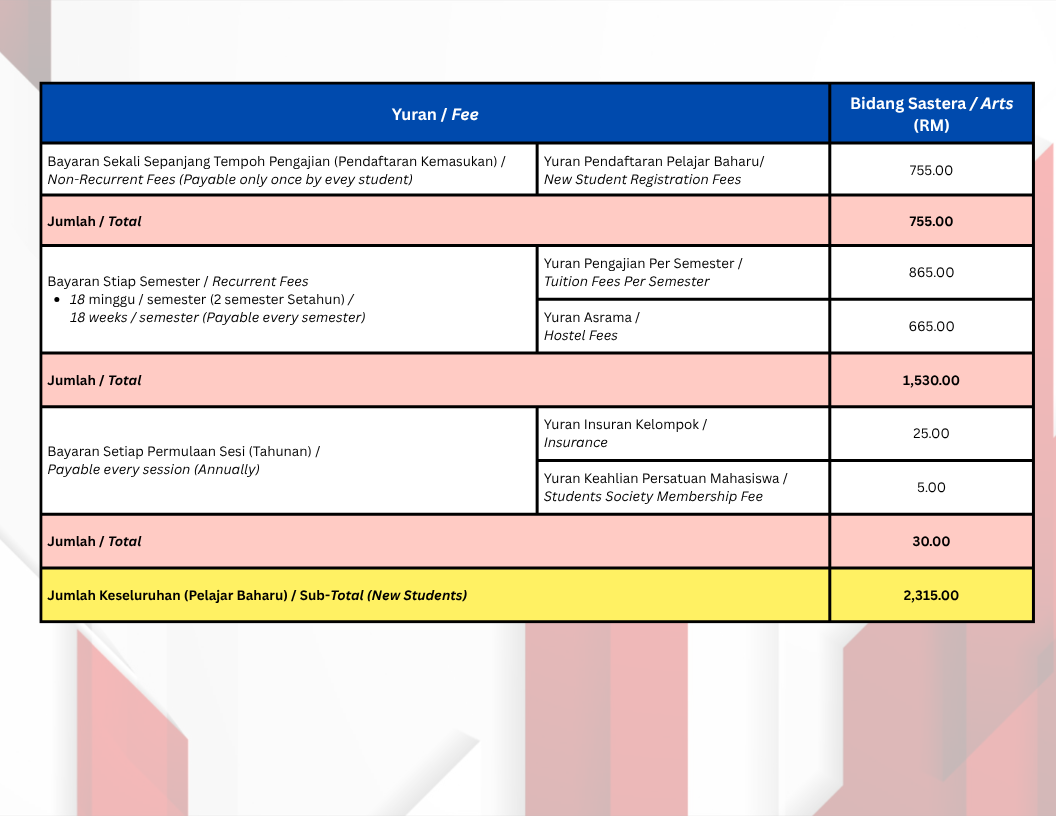

Fee Structure

How To Apply

Contact